If you have an Amex card, you’ll likely have some form of travel insurance

A recent trip abroad took me to an unexpected place: the dentist. Not one, but twice, and it culminated in some emergency root canal surgery. Thankfully, the dentist was excellent, and I was able to enjoy the rest of my holiday without pain, but their care and attention came at a price. When I returned to the UK, I used my Amex to cover these unexpected costs.

Which American Express cards have travel insurance?

Amex offer a range of cards, and there’s a range of different cover levels. Typically, the more you spend on the annual fee, the greater and wider the insurance coverage.

Most, but not all, cards have a base level of coverage that will protect you from travel inconveniences and baggage delays. The baggage cover can change significantly between cards – the BA Amex Premium Plus offers up to £1,750 of cover for delayed bags, whereas the Amex Business Platinum offers just £600.

The types of travel cover that cards could have include:

- Travel inconvenience cover; if your flight is delayed and you incur costs

- Baggage delay cover, with more paid out if your baggage is really late (quoted in some policies as 48 hours)

- Trip cancellation, postponement or abandonment cover

- Personal belongings cover.

- Car rental cover; this one is a little rarer across the cards

- Medical assistance and expenses cover

- Personal accident cover while on holiday

Hijacked? They have you covered

The most interesting cover difference that I saw was on the BA Accelerating Business Card and the rare (but I have them both) USD and EUR Business cards. If you paid for a ticket using the card itself, or points from the card, and your transportation is hijacked, then you’ll get up to £1,500 after 24 hours and a further £3,000 after 72 hours. In the unlikely event that you claim for this, then you’ll get paid in dollars or Euros if you claim via that particular card.

It’s also worth noting that some Amex cards provide coverage for refund protection and purchase protection. These are not specifically related to travel, but on some cards you can claim up to £2,500 per item if a purchase is stolen or damaged in the first 90 days of ownership, or up to £300 per item if a UK-based retailer won’t allow you to return an item.

Amex travel insurance by card

The information below is accurate at the time of writing. Please check with Amex or Europ Assistance for current cover levels, as additional terms may apply to any coverage beyond what is outlined below.

Personal Cards

| Card | Who is covered | Coverage Details | Insurance Coverage |

|---|---|---|---|

| BA Premium Plus Card | Coverage is for Main cardholder Cardholders’ family (spouse/partner & children living at home up to 25 years old) Supplementary cardholders (but not their families) | Business & leisure trips cover Worldwide cover | Travel inconvenience Upto £600 Baggage delays Upto £1,750 Travel / Personal Accident Up to £250k |

| BA Standard Card | Coverage is for Main cardholder Cardholders’ family (spouse/partner & children living at home up to 23 years old) Supplementary cardholders (but not their families) | Business and leisure trips cover Worldwide cover | Travel / Personal Accident Up to £75k |

| Platinum Card | Coverage is for Main cardholder Cardholders’ family (spouse/partner & children living at home up to 25 years old) Supplementary cardholders (but not their families) | Worldwide cover | Medical Assistance & Expenses Upto £2m (£1k for emergency dental) Trip cancellation, postponement, abandonment Up to £7,500 per person Travel inconvenience Upto £300 Baggage delays Upto £600 Travel / Personal Accident Up to £50k |

| Gold Card | Coverage is for Cardholder only | Worldwide cover | Travel inconvenience Upto £200 Baggage delays Upto £490 Travel / Personal Accident Up to £250k |

| Cashback Cards | Main cardholder Cardholders’ family (spouse/partner and children living at home up to 23 years old) Supplementary cardholders (but not their families) | Worldwide cover | Travel / Personal Accident Up to £150k |

| Nectar Card | No travel insurance cover | ||

| Marriott Bonvoy Card | Coverage is for Cardholder only | Worldwide cover | Travel inconvenience Upto £150 Baggage delays Upto £1,450 Travel / Personal Accident Up to £150k |

| Vitality Card | Coverage is for Cardholder only | Worldwide cover | Travel / Personal Accident Upto £150k |

Business Cards

| Card | Who is covered | Coverage Details | Insurance Coverage |

|---|---|---|---|

| BA Accelerating Business Card | Coverage is for Main cardholder and family Supplementary cardholders | Worldwide cover | Travel inconvenience £200 for travel delays prior to trip (£250 for BA flights) Baggage delays (Upto £1,750, or £2,250 if BA) Travel / Personal Accident Upto £250k |

| Business Platinum Card | Coverage is for Main cardholder Cardholder’s family (spouse/partner & children living at home up to 25 years old) Employee cardholders (but not their families) | Business & leisure trip cover Trips of up to 120 days in length Worldwide cover | Medical Assistance & Expenses Upto £2m (£1k for emergency dental) Trip cancellation, postponement, abandonment Up to £7,500 per person Travel inconvenience £150 for travel delays prior to trip Baggage delays (Upto £600) Travel / Personal Accident Upto £50k |

| Business Gold Card | Coverage is for Main cardholder Cardholder’s family (spouse/partner & children living at home up to 25 years old) Employee cardholders (but not their families) | Business and leisure trip cover Worldwide cover | Travel inconvenience £200 for travel delays prior to trip Baggage delays (Upto £600) Travel / Personal Accident Upto £250k |

| Business EUR/USD Card | Coverage is for Main cardholder Cardholders’ family (spouse/partner & children living at home up to 25 years old) Supplementary cardholders (but not their families) | Business & leisure trip cover Trips of up to 120 days in length Worldwide cover | Travel inconvenience $/€175 for travel delays prior to trip Baggage delays (Upto $/€800) Travel / Personal Accident Upto $100k or €100k |

| Amazon Business or Prime Card | No travel insurance cover | ||

| Business Basic Card | No travel insurance cover |

How do you claim on Amex travel insurance?

Amex changed its insurance provider on the 1st January 2025, from AXA to Europ Assistance, which means that from that date onwards, you’ll be submitting a claim to Europ Assistance. You’ll also be using their portal to submit the claims.

Step 1 – Logging in to the Europ Assistance portal

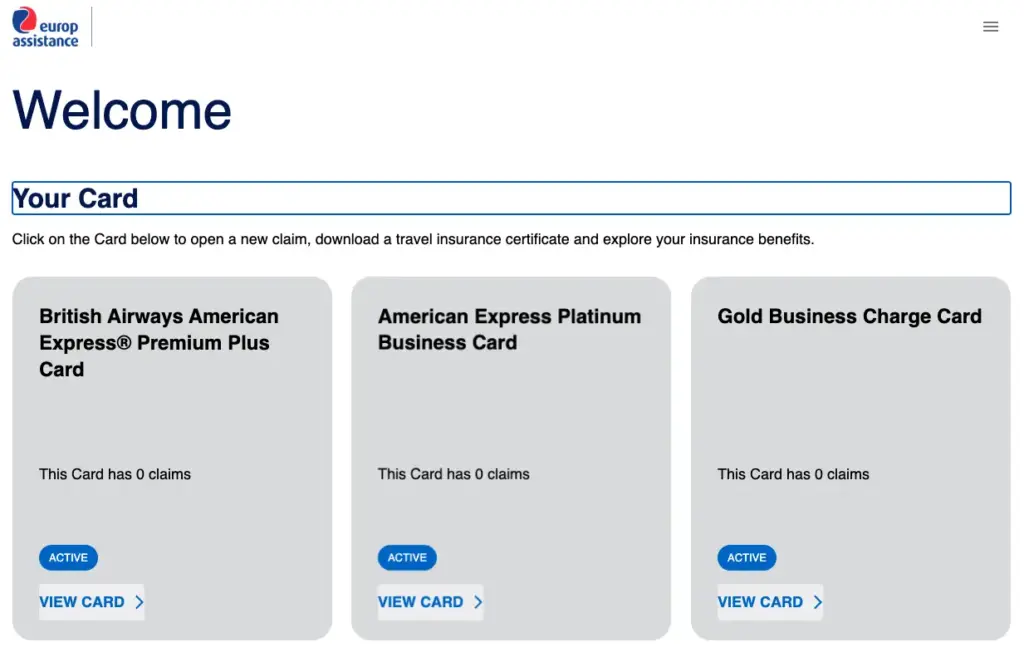

If you think about insurance companies, then “ease of use” might not be the first words that come to mind. Thankfully, the Europ Assistance portal is actually one of the better ones. They’ll ask you to share your email and set up a password. Once you’re logged into the platform, you’ll then add in your American Express cards.

Step 2 – Adding your cards to the portal

Even if you believe you want to claim using one particular card, I suggest adding all your Amex cards to ensure you can view the coverage levels on each card. It’s possible that your understanding of what each card covers is incorrect.

Adding in cards is easy, and it requires you to enter only the credit card number itself. No validation is needed, nor is any additional information, such as the expiry date or CVV, required. That makes this process quick.

Once you’ve added your cards, they will all be visible on the portal’s homepage.

For each card, you’ll be able to download your policy documents, request a travel insurance certificate, open a claim and also check what the insurance on that card actually covers.

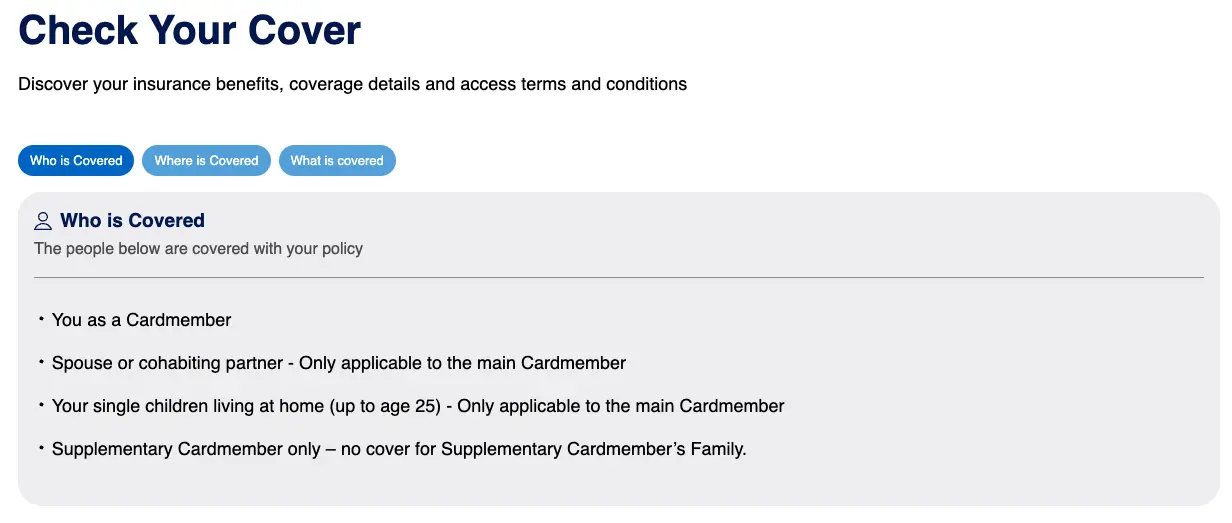

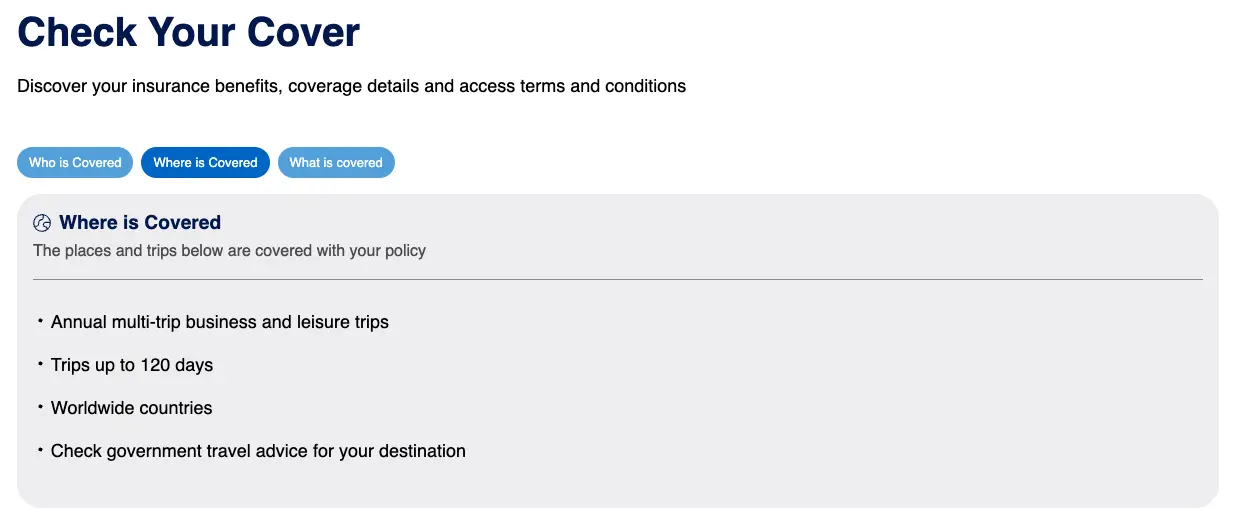

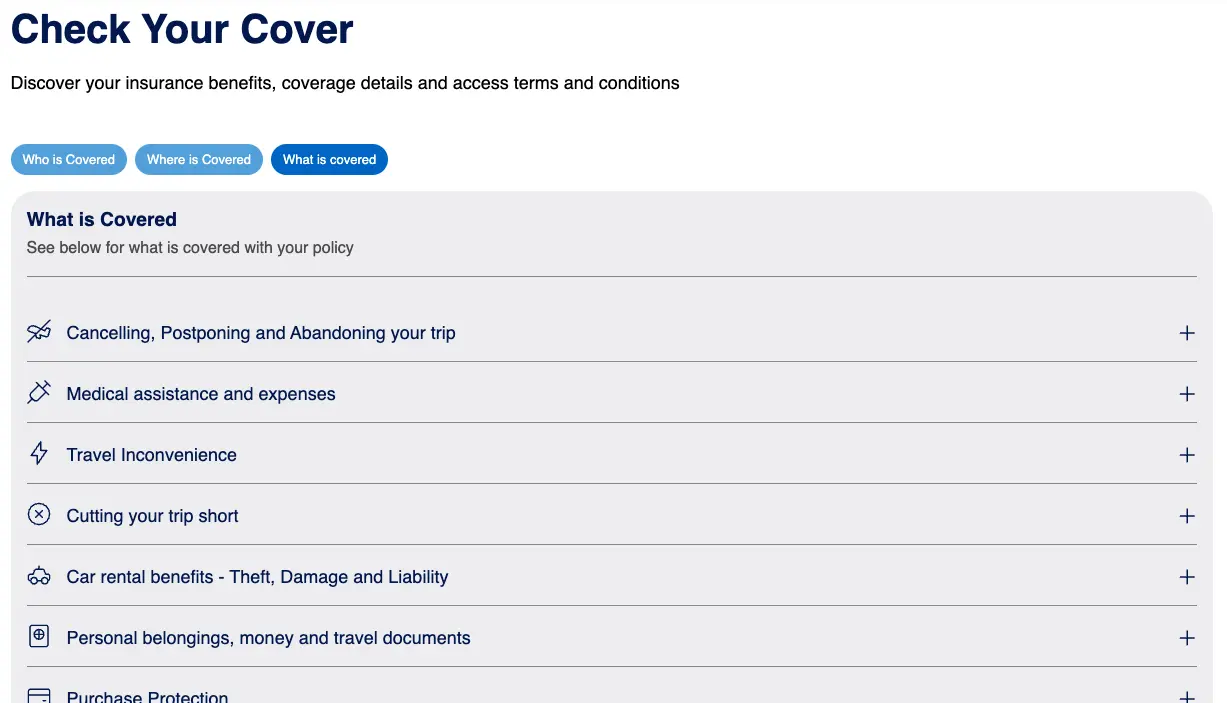

Step 3 – Check your cover levels

When you’ve added your card numbers in, you’ll be able to click in to each card and see your cover levels. I found this part of the process to be particularly user-friendly.

If you’ve ever trawled through insurance documents in the past, then you’ll know that it can be difficult to make sense of the documents. Even the more simplistic overview pages can be a little unclear.

Amex split the cover into categories, and the information provided is really clear. I was able to scan through my cards, understand which ones provided cover relevant to my issue, and that allowed me to work out whether I was even covered for what I wanted to claim.

Step 4 – Start the claim

Clicking into the card you want to start the claim with, you’ll tap the open new claim button.

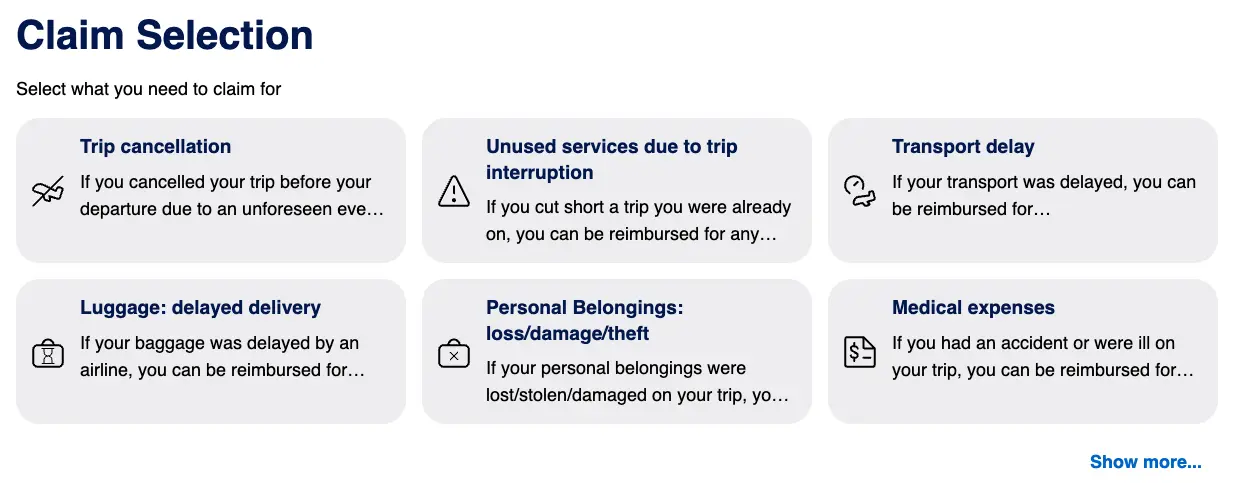

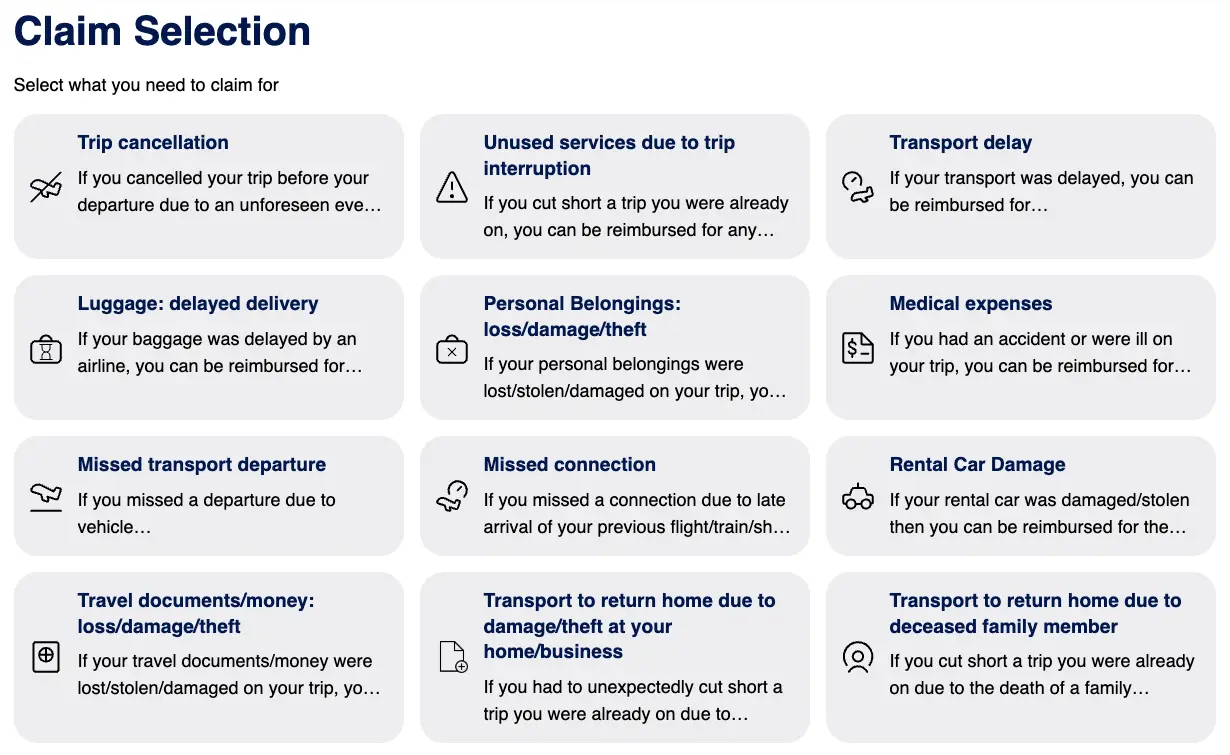

Firstly they ask you to select the type of claim.

There’s a small and easy-to-miss “Show more” button at the bottom right of the initial list of claim types. This opens up a list of further claim types. It’s worth clicking this just to make sure your claim isn’t on this secondary list.

Claims are automatically saved, but what’s not made clear is that this happens at the end of each step. If you partially complete Step 1, then move away from the site, the details you have entered won’t be saved. You’ll also get an email from the portal with a link to your uncompleted claim.

Any open claims will appear at the top of the card homepage, and you can click into them to restart where you left off.

The information requested will change based on the type of claim that you have, but for my medical claim, the process had five steps. I found it easy to complete each step, although sometimes the drop-downs would list items in a strange order.

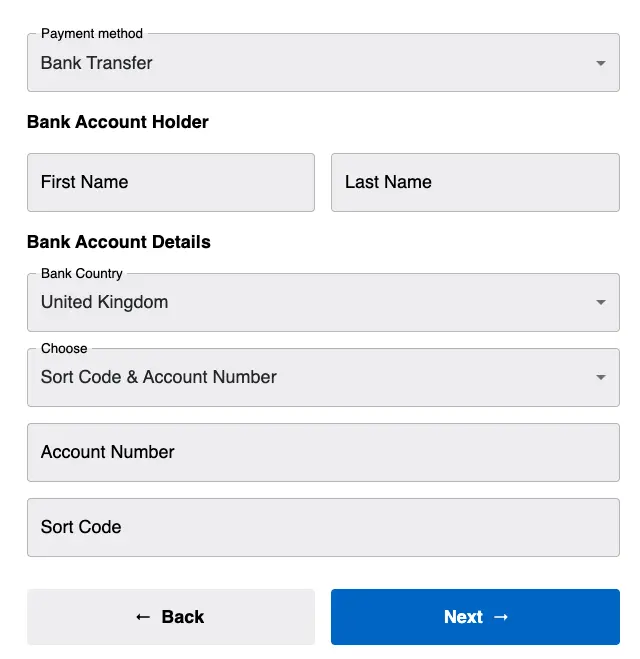

Once I entered information on the claim itself, including the specific costs that I was claiming, I was asked to enter the bank details to which the money would be sent.

You can enter bank account details for a number of countries, and if you select the UK, you can enter either the typical sort code and bank account combination, or the lesser-used BIC and IBAN.

Step 5 – Submitting the documents

The final step in the process is to submit the documents related to the claim.

Important: If you’re submitting a medical claim, then it will ask for invoices you are claiming against, documents relating to your trip and a completed medical report. The latter required you to complete a template, and this is not provided on this screen.

This part of the process is the most complex. I went back to the homepage to see how I download the form and couldn’t see any options. I had to open a second claim to get access to the document. For ease, if you’re submitting a medical expenses claim, then you’ll need to complete this medical report PDF. It will also need to be completed (and signed) by a medical professional.

What happens next?

I’m waiting for a response to my submission, but I’ll update this article with what happened with my case. Looking at the experience of others, they have reported prompt payments on credible claims, and also a fairness around what costs have been approved as part of the claim.

Update: It’s not easy getting hold of Europ Assistance. I’ve tried their live chat multiple times over the last few days, and it just says that all their agents are busy. To speak to them, you need to go through American Express by calling the number on the back of your card. I did manage to get through to the Europ Assistance team, and they were helpful. A few days after submitting my documents, I had an inbound call from them, as two of the documents I shared were incorrect.

Add a comment